Quarterly Economic Outlook: Hope or heartbreak in 2026?

Professional sports don’t often serve up suitable parallels to the complex dynamics of national economies and financial markets. However, 2025 was an exception, at least for Canadian businesses, investors, and policymakers. Multiple Canada-based teams competed in their respective league championships against U.S.-based rivals at a time of heightened trade and political frictions between Canada and its largest and wealthiest trade partner. Unfortunately, all of these matches ended in heartbreak for Canadian sports fans. While there are obvious risks to Canada’s economic performance in 2026, heartbreak isn’t guaranteed, and there are even some reasons to be hopeful.

A difficult year, politically and athletically

2025 was a challenging year for Canada. Trade and other political frictions with the Trump administration weren’t the entire story.

In October, the Toronto Blue Jays treated baseball fans to an impressive playoff run culminating in an American League pennant and World Series berth. A win over a U.S.-based rival would have been welcome news to anyone in an “elbows-up” frame of mind. Unfortunately, after taking the Los Angeles Dodgers, with Major League Baseball’s largest payroll, to a deciding game seven, the Jays fell short at home in extra innings by just one run.

In December, Major League Soccer’s (MLS) Vancouver Whitecaps embarked on their own magical playoff run, punching their ticket to the MLS Cup final after a memorable home win in blizzard conditions. But for the second time in two months, a Canadian team went head-to-head with its league’s highest-payroll team (in this case, Lionel Messi’s Inter Miami) before coming up short.

And of course, most hockey fans are aware of the more-than-30-year Stanley Cup drought for Canada-based National Hockey League (NHL) teams. The Edmonton Oilers had a shot at ending that streak in June of last year. But after pulling even with the Florida Panthers—once again, an opponent with its league’s highest-paid roster—through the first four matches, a U.S.-based opponent prolonged the pain for Canadian NHL teams.

Of course, when thinking about parallels between sports and political economy, it’s important to remember that the underdog Toronto Raptors won an NBA championship in 2019 against that league’s highest-paid roster. As difficult as 2025 was for Canadian sports fans, reaching three league finals is still an impressive feat, and victories are still possible.

Hope or heartbreak in 2026?

How might the coming year play out for Canada’s economy, governments, businesses, workers, and consumers? It remains to be seen. As already noted, macroeconomic dynamics are quite unlike the straightforward win-lose frameworks of professional sports, so it’s probably not reasonable to expect a clear winner and a clear loser in the current frictions between Canada and the U.S.

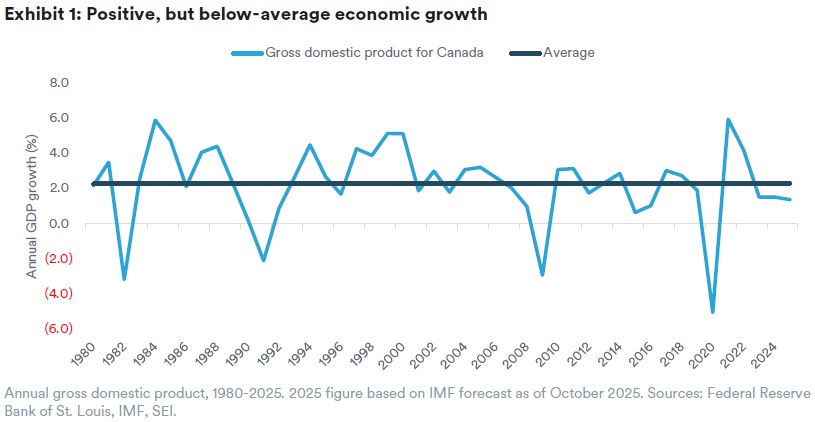

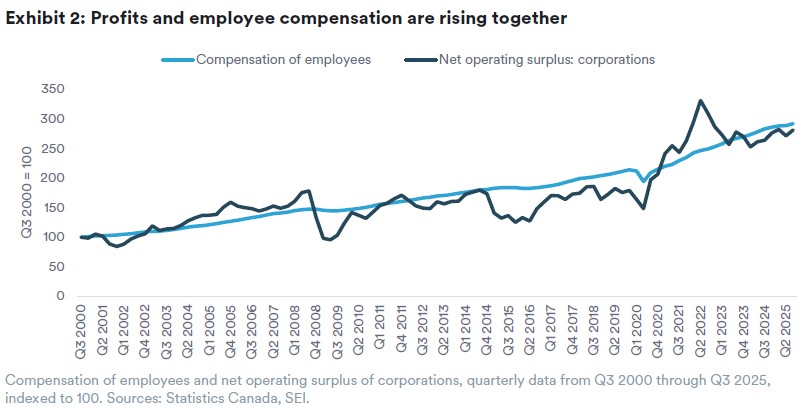

Although economic growth has been nothing to get too excited about (Exhibit 1), Canada largely outperformed expectations in 2025. The Bank of Canada continued to ease policy by cutting its interest-rate target. Corporate profits and employee compensation continued to grow (Exhibit 2); unemployment improved notably starting in the fall; and preliminary figures indicate that, despite ongoing pressure on household balance sheets, consumer spending continued to rise as the year drew to a close.

As we’ve noted previously, the performance of the global economy will remain an important factor for Canada’s outlook. While prevailing consensus is for further slowing of global growth—due to factors such as “prolonged uncertainty, more protectionism, and labor supply shocks,” according to the International Monetary Fund (IMF)1—global activity should still prove supportive. We expect positive fiscal impulses in a number of countries. While major central banks (with the notable exception of the Bank of Japan) nearing the end of their rate-cutting cycles might seem negative on its face, it should mean less uncertainty around interest-rate outlooks, and the effects of past interest-rate cuts should continue to work their way through national, regional, and global economies, including Canada’s. Finally, although the loonie strengthened against the U.S. dollar in December, it remained relatively weak versus a broad range of trading partners, which may provide additional support to export activity as Canada seeks to develop stronger trading ties beyond its neighbour to the south.

If there’s a single area that could prove critical to the outlook in 2026 and beyond, it’s trade. The planned renegotiation of the Canada-United States-Mexico Agreement (CUSMA) among the three trading partners is the clearest risk and one we will be watching closely. But the federal government’s attempts to expand trade with non-U.S. countries and business activity within Canada are also critically important. Will they bear fruit in terms of trade, corporate profits, and household incomes? Only time will tell, and most of these things are well beyond investors’ control.

What can we control?

While that may sound unsettling, it’s important to remember these are some of the kinds of risk investors expect to be compensated for assuming over the long term. Holding a diversified portfolio that is well-suited to one’s objectives and circumstances is well within investors’ control. And while it may be challenging, staying off emotional rollercoasters that can accompany things like cheering for professional sports teams is also a good idea in life—especially when investing.

Glossary and index definitions

For financial term and index definitions, please see: https://www.seic.com/ent/imu-communications-financial-glossary

Important information

SEI Investments Canada Company, a wholly owned subsidiary of SEI Investments Company, is the Manager of the SEI Funds in Canada.

The information contained herein is for general and educational information purposes only and is not intended to constitute legal, tax, accounting, securities, research or investment advice regarding the Funds or any security in particular, nor an opinion regarding the appropriateness of any investment. This information should not be construed as a recommendation to purchase or sell a security, derivative or futures contract. You should not act or rely on the information contained herein without obtaining specific legal, tax, accounting and investment advice from an investment professional. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. There is no assurance as of the date of this material that the securities mentioned remain in or out of the SEI Funds.

This material may contain "forward-looking information" ("FLI") as such term is defined under applicable Canadian securities laws. FLI is disclosure regarding possible events, conditions or results of operations that is based on assumptions about future economic conditions and courses of action. FLI is subject to a variety of risks, uncertainties and other factors that could cause actual results to differ materially from expectations as expressed or implied in this material. FLI reflects current expectations with respect to current events and is not a guarantee of future performance. Any FLI that may be included or incorporated by reference in this material is presented solely for the purpose of conveying current anticipated expectations and may not be appropriate for any other purposes.

Information contained herein that is based on external sources or other sources is believed to be reliable, but is not guaranteed by SEI Investments Canada Company, and the information may be incomplete or may change without notice. Sources may include Bloomberg, FactSet, Morningstar, Bank of Canada, Federal Reserve, Statistics Canada and BlackRock.

There are risks involved with investing, including loss of principal. Diversification may not protect against market risk. There may be other holdings which are not discussed that may have additional specific risks. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavourable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors, in addition to those associated with their relatively small size and lesser liquidity. Bonds and bond funds will decrease in value as interest rates rise.

Index returns are for illustrative purposes only, and do not represent actual performance of an SEI Fund. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.