Quarterly Economic Outlook: Assessing Canada’s outlook, by looking abroad

In recent quarters, we predicted the political and policy environments could get quite interesting and that economic outlooks—both in Canada and worldwide— were highly uncertain as a result. Those expectations have certainly proven true through the first three quarters of 2025. In the following update, we’ll briefly review the domestic environment and then discuss the importance of the global outlook to Canada’s economic fortunes.

There are headwinds…

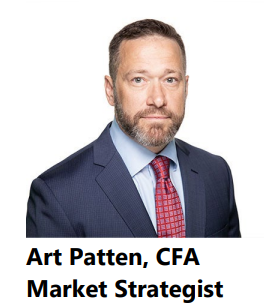

The two major headwinds to domestic economic performance remain household indebtedness (Exhibit 1) and the labour market, where the unemployment rate continued to rise, reaching 7.1% through August.

Despite these headwinds, the Canadian economy has continued to demonstrate resilience, with a formal recession yet to take hold. This is almost certainly due in part to fiscal support measures at the federal level and (thanks to comparatively better progress on lowering inflation) relatively low interest rates. It’s important to note, however, that Canada’s economic fortunes are also tightly linked to external developments. This is not surprising given its categorization as a small, open economy, but even more important given the stretched state of household finances. While the global economy also faces plenty of uncertainty, there are reasons to believe it will continue to lend some support to activity within Canada. As a result, there are grounds for guarded optimism, despite the discouraging domestic employment situation and ongoing trade upheaval with the U.S.

…but also guarded optimism, despite global uncertainty

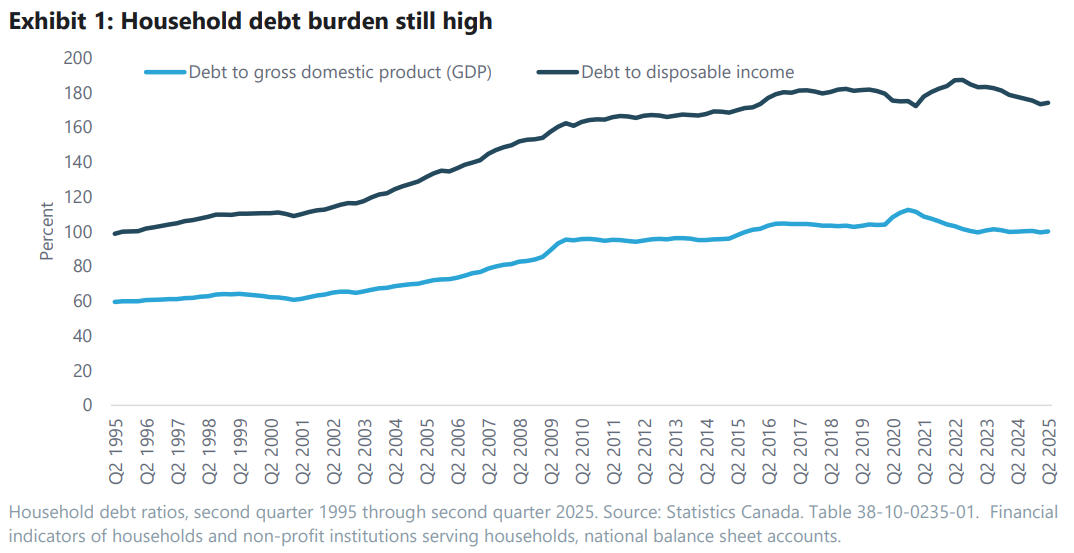

There are still reasons to be concerned about the global economic outlook. Obvious examples include the potential for stubbornly high and even reaccelerating inflation, the Trump Administration’s ongoing attacks on prior global trade and immigration patterns, military conflicts, and, as shown in Exhibit 2, softening labour markets in many countries. The latter is an area where Canada stands out, unfortunately.

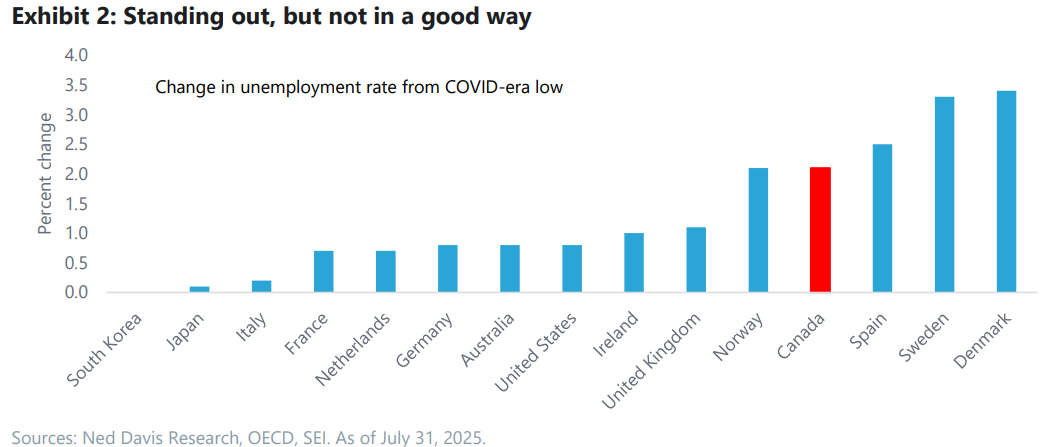

While some of the countries that have experienced a surge in unemployment are, like Canada, faced with high household debt levels, that factor alone does not explain the dynamic, as demonstrated by the data shown in Exhibit 3.

However, investors shouldn’t overlook that the global economy has continued to chug along despite all the aforementioned risks, high levels of uncertainty, and some notably softer national labour markets. Nor should they ignore that global activity appears to have lent a welcome measure of support to the Canadian economy recently. For example, after struggling in the second quarter, a rebound in economic growth during July was driven by export-oriented sectors such as mining, energy, and manufacturing. This helped overcome the recent contraction in domestic retail activity, according to Statistics Canada. As we noted in our previous economic outlook, the expansion of exports to countries other than the U.S. was encouraging, and Canada stood to benefit from continued gold and precious metals demand by foreign central banks seeking to diversify massive (especially in the case of the People’s Bank of China) foreign-currency reserves. If investor interest in this theme continues to broaden, it should lend further support to the domestic mining sector.

One especially important dimension to the global outlook is the likelihood of expanded fiscal expenditures in many countries over the rest of the 2020s. This includes Canada, where larger deficits are expected to be driven by defence spending and infrastructure investment, although details won’t be clear until the government’s long-delayed budget is finally released— hopefully—in early November. This being said, a number of other countries have been running and/or are expected to run sizeable deficits in the years ahead, including China, France, Germany, Japan, the U.K. and the U.S.1 While this could raise the risk of unwanted inflation and thus make some central bankers’ jobs more difficult, it should also be supportive of overall global activity. If it is, a small, open economy like Canada’s that’s actively seeking to expand trade relationships beyond the U.S. could benefit.

A special relationship revisited

While Canada’s gross domestic product contributions from construction and agriculture were flat in July, U.S. immigration and trade policies could provide Canada with a competitive edge in those sectors. Immigration to the U.S. has slowed to a trickle in 2025, and the U.S. agricultural sector is facing some tariff-induced struggles. Although Canada’s previous government implemented measures to marginally slow immigration flows, Canada remains an immigration-friendly destination overall. Residential construction remains a policy priority, and the federal government has engaged in efforts to expand trade agreements with countries other than the U.S. While highly speculative at this point, it’s plausible sectors like agriculture and construction could lend additional support to future growth. Speculating further, the Trump administration’s recently announced plans to charge six figures for H-1B visas could create an opening for Canada to better compete for global tech-sector labour, as Prime Minister Carney observed in recent public remarks.2

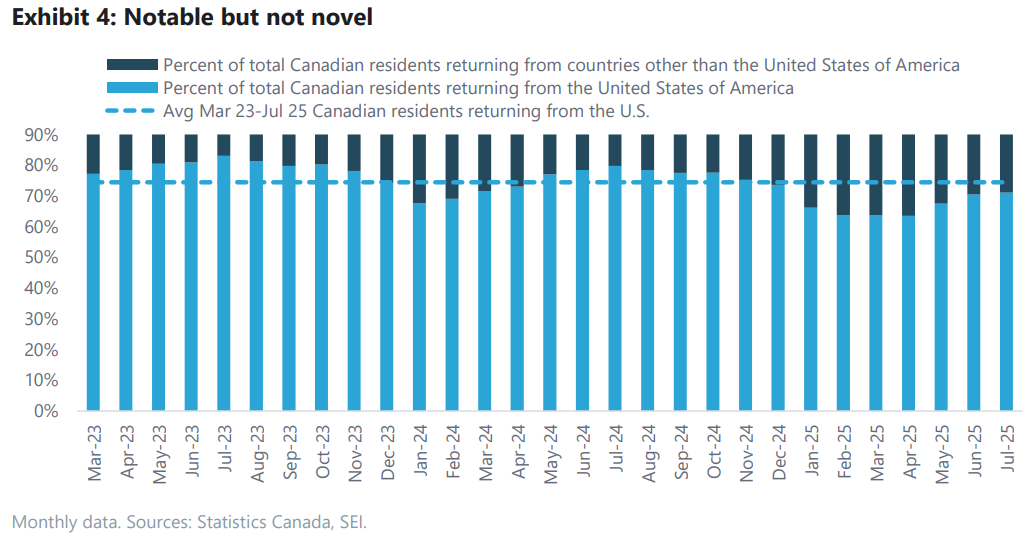

There’s been a fair amount of attention paid to the “Elbows Up” movement and similar expressions of anti-American (or at least anti-Trump) sentiment in Canada this year, with notable shifts in consumer preferences towards goods produced domestically or anywhere but America and, reportedly, travel preferences. As noted in our previous outlook, exports to non-U.S. destinations increased significantly. However, it remains to be seen how permanent these changes will be and whether they will persist in services sectors such as travel. While Statistics Canada and various news outlets have claimed that reduced travel to the U.S. marks a notable shift in Canadians’ preferences, some historical context argues that more data is needed before drawing any firm conclusions. As shown in Exhibit 4, we have seen a strong preference among Canadian travelers for destinations outside the U.S. before.

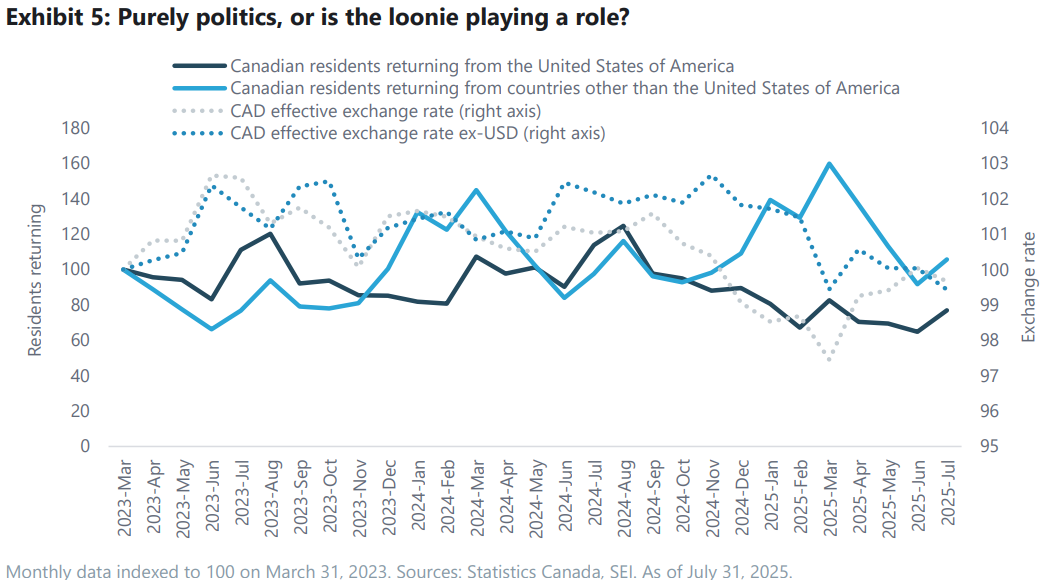

And as Exhibit 5 indicates, these fluctuations may be due at least in part to exchange rate dynamics. Although we’re only looking at two-plus years’ worth of data, it appears that travel preferences have previously shifted when the Canadian dollar was stronger or weaker versus U.S. or non-U.S. foreign currencies.

As entertaining as these speculations might be, we can set them aside, wait for further data, and focus on the more important issue of Canada’s overall trade relationship with the U.S. and North America more broadly. Renegotiation of the Canada-U.S.-Mexico Agreement (CUSMA), which was struck with the first Trump Administration and replaced the North American Free Trade Agreement or NAFTA, is expected to take place sometime in 2026. There are still unknowns around how this process will unfold. Unfortunately, it appears to be off to a rocky start, with the U.S. engaging in unilateral study and consultation. Meanwhile, there have been trade-related overtures between Canada and Mexico. We will be keeping a close eye on further developments.

Despite the suspense, there have been some welcome developments in the Canada-U.S. trade dynamic. First is the abandonment of retaliatory tariffs by Canada. As unsatisfying as that might be politically, it’s an economic positive on balance. If your major trading partner intentionally drops an anvil that hits you squarely on the foot while crushing a few of its own toes, why repeat the process from your side? The number of goods deemed compliant with CUSMA has also helped keep the effective U.S. tariff rate on Canada at a somewhat manageable level to date. Furthermore, anticipated U.S. Supreme Court decisions on the legality of Trump’s various tariff measures in the coming weeks or months will—again, hopefully—provide some much-needed clarity.

What’s next for investors?

The investment upshot of all of this remains the same:

• Invest wisely

• Make sure your portfolio strategy aligns well with your objectives and requirements

• Make the most of diversification opportunities

• Stick to your investment and rebalancing disciplines

• And, as always, don’t let emotions steer your decision making

Stay tuned, there are sure to be interesting times ahead.

Definitions

Debt refers to money that is borrowed by one party from another, typically with the agreement that it will be repaid at a later date, usually with interest. It can take many forms, including loans, bonds, or credit arrangements, and is commonly used by individuals, businesses, and governments to finance purchases or investments that they cannot immediately afford.

Disposable income refers to the amount of money that an individual or household has available to spend or save after income taxes and other mandatory expenses have been deducted. It represents the net income that can be used for essential expenses, discretionary spending, or savings. In the context of personal finance and investing, understanding your disposable income is important for budgeting, planning investments, and managing day-to-day financial decisions.

Gross domestic product (GDP) refers to the total monetary value of all goods and services produced within a country's borders over a specific period, typically one year. It serves as a key indicator of a nation's economic health and growth, reflecting the overall size and performance of its economy. GDP is commonly used by policymakers and investors to assess economic trends and make informed decisions about fiscal and monetary policies.

Important information

SEI Investments Canada Company, a wholly owned subsidiary of SEI Investments Company, is the Manager of the SEI Funds in Canada.

The information contained herein is for general and educational information purposes only and is not intended to constitute legal, tax, accounting, securities, research or investment advice regarding the Funds or any security in particular, nor an opinion regarding the appropriateness of any investment. This information should not be construed as a recommendation to purchase or sell a security, derivative or futures contract. You should not act or rely on the information contained herein without obtaining specific legal, tax, accounting and investment advice from an investment professional. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. There is no assurance as of the date of this material that the securities mentioned remain in or out of the SEI Funds.

This material may contain "forward-looking information" ("FLI") as such term is defined under applicable Canadian securities laws. FLI is disclosure regarding possible events, conditions or results of operations that is based on assumptions about future economic conditions and courses of action. FLI is subject to a variety of risks, uncertainties and other factors that could cause actual results to differ materially from expectations as expressed or implied in this material. FLI reflects current expectations with respect to current events and is not a guarantee of future performance. Any FLI that may be included or incorporated by reference in this material is presented solely for the purpose of conveying current anticipated expectations and may not be appropriate for any other purposes.

Information contained herein that is based on external sources or other sources is believed to be reliable, but is not guaranteed by SEI Investments Canada Company, and the information may be incomplete or may change without notice. Sources may include Bloomberg, FactSet, Morningstar, Bank of Canada, Federal Reserve, Statistics Canada and BlackRock.

There are risks involved with investing, including loss of principal. Diversification may not protect against market risk. There may be other holdings which are not discussed that may have additional specific risks. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavourable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors, in addition to those associated with their relatively small size and lesser liquidity. Bonds and bond funds will decrease in value as interest rates rise.

Index returns are for illustrative purposes only, and do not represent actual performance of an SEI Fund. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated