SEI Forward.

Market review

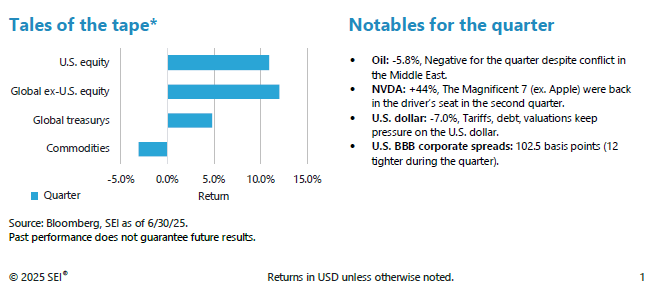

Markets scaled a wall of worry in the second quarter of 2025—geopolitics took center stage from tariff turbulence, while equity markets rallied sharply from the post “Liberation Day” lows. Delays on implementing broad-based tariffs and progress with certain negotiations, including China, gave investors confidence to buy the early April equity dip and push the S&P 500 Index to an all-time high to close the quarter.

Even the lack of progress with the Russia/Ukraine war and the escalation of the conflict between Israel and Iran, including the U.S. bombing of Iranian nuclear sites, were not enough to derail the risk rally. In fact, even oil and volatility markets failed to hold gains from the price spike following news of the U.S. involvement given the subdued Iranian response, open shipping lanes in the Strait of Hormuz, and a clear desire from the U.S. administration to limit further actions.

While markets were resilient during the quarter, we begin the second half of the year with additional walls to climb (including the looming expiration of tariff delays and the likely flow through of trade policies already in place into near-term economic data).

There are bright spots, however, most notably the fiscal and monetary stimulus being implemented around the globe—which may soon include the U.S. as the Federal Reserve (Fed) is poised to cut interest rates, and the Trump 1.0 tax cuts appear likely to be extended.

Halftime report: What have we learned?

Given the unpredictable year we’ve had thus far in 2025, it may be worth exploring areas where we have some semblance of clarity, if not certainty, that are likely to be market drivers in the second half of the year.

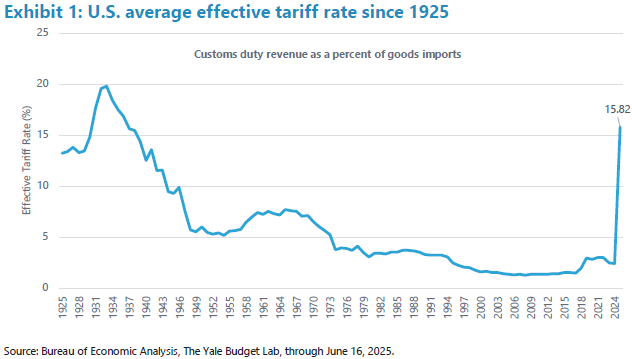

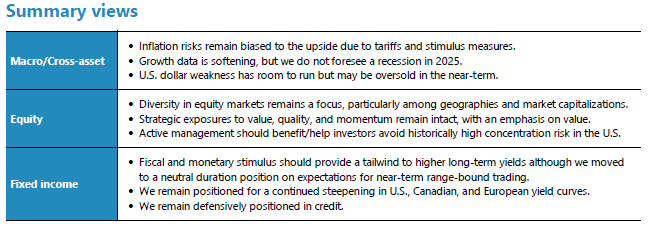

First and foremost, the global trade dynamic will be changing dramatically. U.S. Tariffs have already reached their highest levels in more than 85 years (Exhibit 1) and are likely to remain there at a minimum. While the specific details regarding imposed and reciprocal rates as well as timing are still uncertain, we can confidently assume a negative impact on global economic growth and a boost to inflation, if only temporarily. Monetary stimulus in the U.S. is likely to resume in the later part of 2025, but only after a clearer picture of trade policy emerges later in the summer.

Developed government debt growth will continue unabated. European fiscal spending, including a significant commitment to defense budget expansion, was the story of the first quarter, while the DOGE bust and the continuing debates surrounding the U.S. budget bill grabbed headlines more recently. Regardless of the final budget details, one thing is for sure, there will be no slowing in the growth of developed world government debt in the near term. We see this as a structural tailwind for higher longer-term rates even with central banks back in easing mode. Yield curves have already steepened, particularly in the U.S., and have more room to move, notably in Europe.

U.S. dollar weakness has accelerated in 2025. The dollar declined by 7% in the second quarter and more than 10% since the highs of the year on tariff policies, slowing growth concerns, and substantial monetary and fiscal stimulus announced outside of the United States. Notably, the U.S. dollar failed to rally during the stock market decline in the first half of the year, calling into question the safe-haven status of the currency in current market conditions and suggesting the start of a more secular decline. We are sympathetic to the weak U.S. dollar viewpoint although we do suspect that the near-term selling may be overdone. We also have a positive view on gold as a safe haven asset in the current environment and like the supply/demand dynamics even after the strong rally. While the “barbarous relic” is up over 25% year-to-date on increasing demand from both investors and central banks, we believe a weak U.S. dollar environment will act as an additional tailwind.

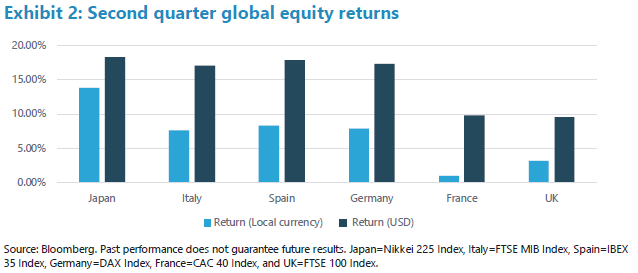

The divergence in equity valuations between the U.S. and the rest of the world remains wide. While the valuation gap has narrowed thus far in 2025, it has been mostly driven by higher multiples outside the U.S. as opposed to a decline in the lofty U.S. valuation. The widely expected buyers strike on U.S. assets doesn’t appear to have materialized, however, weakness in the U.S. dollar during the rebound in U.S. equities does suggest that global investors are interested in at least partially hedging their exposures. We have strategically recommended removing any home country bias from investor equity portfolios along with a 50% currency hedge for investors outside the U.S. U.S. investors have benefitted from unhedged international equity exposure (Exhibit 2) thus far in 2025 which may add some momentum to international outperformance.

Halftime report

While our base case remains that the global economy will avoid recession in 2025, we recognize a slowing in both the hard and soft data. The much-ballyhooed European stimulus will be more of a 2026 and beyond story, and the U.S. Fed is solidly in wait and see mode with tariff uncertainty still unfolding, so it is less than clear if the second half of 2025 will look more like the first or second quarter.

Global diversification in equity markets remains a strategic theme as does our preference for active management, including value, quality, and momentum factors. Despite the Magnificent 7, which trades at nearly 30 times future earnings, dominating performance during the quarter after faltering to start the year, we continue to expect broader participation from U.S. equity sectors and capitalizations in the latter half of the year. Finally, credit spreads remain relatively tight globally yet yields and income are attractive.

As always, we would like to thank our readers for their continued support.

Indexes

*Tales of the tape: U.S. equity: S&P 500 Index; Global ex-U.S. equity: MSCI ACWI ex-U.S. Index; Global Treasurys: Bloomberg Global Treasury Index; Commodities: Bloomberg Commodity Index.

Indexes definitions

The Bloomberg Commodity Index comprises futures contracts and tracks the performance of a fully collateralized investment in the index. This combines the returns of the index with the returns on cash collateral invested in 13-week (three-month) U.S. Treasury bills.

The Bloomberg Global Treasury Index tracks fixed-rate, local currency government debt of investment grade countries, including both developed and emerging markets.

The CAC 40 Index tracks the performance of the 40 largest French stocks traded on the Euronext Paris stock exchange.

The DAX Index tracks the performance of 40 of the largest German companies that trade on the Frankfurt Stock Exchange.

The FTSE 100 Index tracks the performance of shares from the 100 largest companies listed on the London Stock Exchange.

The FTSE MIB Index is the primary large-cap equity benchmark index for the Italian equity market.

The IBEX 35 Index is a market capitalization-weighted index that tracks the performance of the 35 most liquid stocks traded on the Continuous market on the Madrid Stock Exchange in Spain.

The MSCI ACWI ex USA Index tracks the performance of both developed-market and emerging market countries, excluding the United States.

The Nikkei 225 Index tracks the performance of the Japan’s 225 largest companies listed on the Tokyo Stock Exchange.

The S&P 500 Index is a market-weighted index that tracks the performance of the 500 largest publicly traded U.S. companies and is considered representative of the broad U.S. stock market.

Glossary

A basis point equals .01%.

Magnificent 7 refers to the mega cap technology and technology-related U.S. stocks of Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia, and Tesla.

Momentum is a trend-following investment strategy that is based on acquiring assets with recent improvement in their price, earnings, or other relevant fundamentals.

Quality comprises a long-term buy-and-hold strategy that is based on acquiring shares of companies with strong and stable profitability with high barriers of entry (factors that can prevent or impede newcomers into a market or industry sector, thereby limiting competition).

Risk assets, such as equities, commodities, high-yield bonds, real estate, and currencies, carry a degree of risk and generally are subject to significant price volatility.

Value is an investment strategy that is based on acquiring assets at a discount to their fair valuations. Mean reversion is a theory that prices and returns eventually move back towards their historical average.

Important information

SEI Investments Canada Company, a wholly owned subsidiary of SEI Investments Company, is the Manager of the SEI Funds in Canada.

The information contained herein is for general and educational information purposes only and is not intended to constitute legal, tax, accounting, securities, research or investment advice regarding the Funds or any security in particular, nor an opinion regarding the appropriateness of any investment. This information should not be construed as a recommendation to purchase or sell a security, derivative or futures contract. You should not act or rely on the information contained herein without obtaining specific legal, tax, accounting and investment advice from an investment professional. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Statements that are not factual in nature, including opinions, projections and estimates, assume certain economic conditions and industry developments and constitute only current opinions that are subject to change without notice.

This material may contain "forward-looking information" ("FLI") as such term is defined under applicable Canadian securities laws. FLI is disclosure regarding possible events, conditions or results of operations that is based on assumptions about future economic conditions and courses of action. FLI is subject to a variety of risks, uncertainties and other factors that could cause actual results to differ materially from expectations as expressed or implied in this material. FLI reflects current expectations with respect to current events and is not a guarantee of future performance. Any FLI that may be included or incorporated by reference in this material is presented solely for the purpose of conveying current anticipated expectations and may not be appropriate for any other purposes.

Information contained herein that is based on external sources or other sources is believed to be reliable, but is not guaranteed by SEI Investments Canada Company, and the information may be incomplete or may change without notice. Sources may include Bloomberg, FactSet, Morningstar, Bank of Canada, Federal Reserve, Statistics Canada and BlackRock.

There are risks involved with investing, including loss of principal. Diversification may not protect against market risk. There may be other holdings which are not discussed that may have additional specific risks. In addition to the normal risks associated with investing, international investments may involve risk of capital loss from unfavourable fluctuation in currency values, from differences in generally accepted accounting principles or from economic or political instability in other nations. Emerging markets involve heightened risks related to the same factors, in addition to those associated with their relatively small size and lesser liquidity. Bonds and bond funds will decrease in value as interest rates rise.

Index returns are for illustrative purposes only, and do not represent actual performance of an SEI Fund. Index returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.