SEI Forward.

Market review

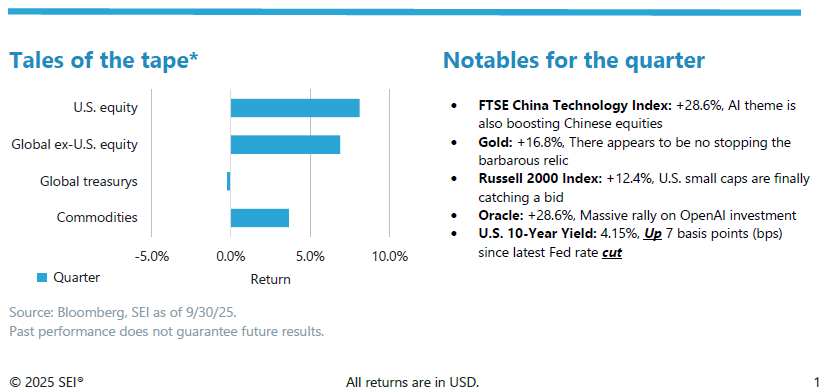

Risk assets continued their ascent during the third quarter. Solid earnings and accommodative policies—both fiscal and monetary—were enough to overcome the hurdles of several tariff announcements and a deteriorating employment picture in the U.S. While artificial intelligence (AI) was once again a dominant theme, the rally broadened during the quarter to finally include U.S. small-cap stocks, which have lagged since the Liberation Day lows in early April. Emerging markets were boosted by the AI carryover into China, while European stocks failed to keep pace due to political turmoil and a stable U.S. dollar.

The U.S. Federal Reserve (Fed) joined the monetary easing party late in the quarter despite strong economic growth, stubborn inflation, and a stock market at or near all-time highs. Job growth was the final straw for policymakers as a massive downward data revision reset the employment picture and prompted the first 2025 rate cut in the U.S. While yields in the U.S. finished the quarter slightly lower, developed-market yields broadly rose over the past 3 months, particularly in Europe, on continued concerns of ballooning debt and political instability in France.

Geopolitics in general remained a pressure point for markets. Hopes for a resolution in the Russia/Ukraine conflict have been dashed, questions concerning President’s Trump’s firing of Fed Governor Cook remain unanswered, and the U.S. government inched closer to a shutdown. Gold was a prime beneficiary as these tailwinds, along with consistent demand from investors and central banks, helped the precious metal reach new highs.

Lower volatility but higher fragility

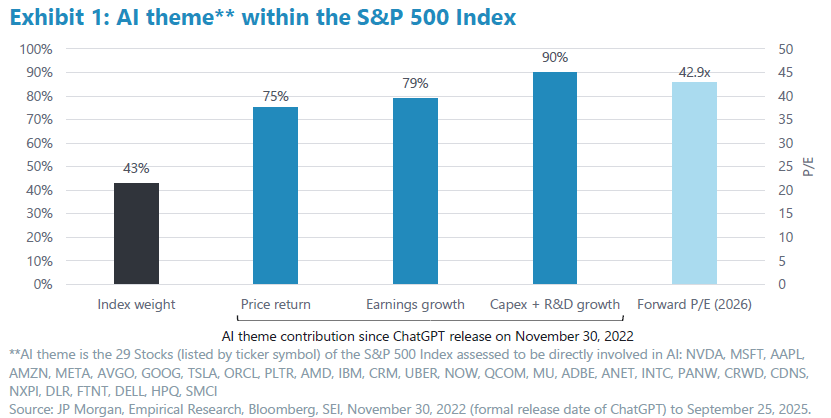

The Magnificent 7 had another, well, magnificent quarter as earnings broadly delivered and the AI capital spending tsunami continued unabated. While we noted the broadening in equity performance over the quarter, these seven names continue to make up a large percentage (over 34%) of the U.S. market capitalization, with most sharing the common thread of being large players in AI. Therefore, perhaps it’s worth digging a bit deeper into AI and the influence this theme has had on equity market earnings growth and returns over the last several years. Our friends at J.P. Morgan and Empirical Research have identified 29 companies designated as directly involved in AI (as opposed to indirectly involved, such as power producers for example).

Using the release of ChatGPT on November 30, 2022, as the “start date” for the AI theme, we see some startling results in Exhibit 1. While these 29 stocks represent a somewhat staggering 43% of the S&P 500 Index’s market capitalization, they are responsible for three-quarters or more of the price return and earnings growth. Nearly all of the growth in capital expenditures and research and development comes from these AI-theme companies. The dominance of the AI theme highlights, at least in part, the resiliency of U.S. equity markets in the face of uncertainties from still raging wars, to the highest tariffs in nearly a century, and still stubborn inflation. This is also directly reflected in equity market volatility. The CBOE Volatility Index, or VIX, measures the expected volatility of the S&P 500 Index over the next 30 days and was extremely well behaved during the third quarter.

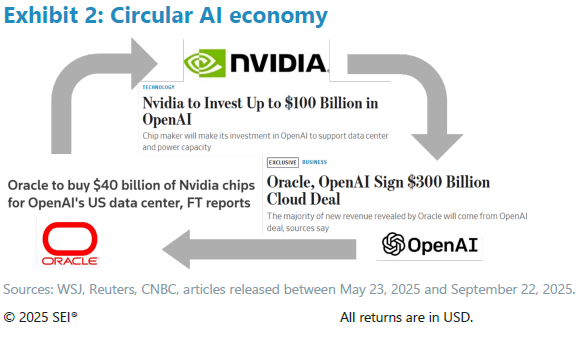

However, despite stellar performance and restrained volatility, we see some growing fragility in the AI theme. Exhibit 2 shares recent headlines which have called attention to the circular nature of AI capital flows and apparent, de facto, vendor financing arrangements.

Risk on but diversify. Fade long-end yields. Gold bull has room to run.

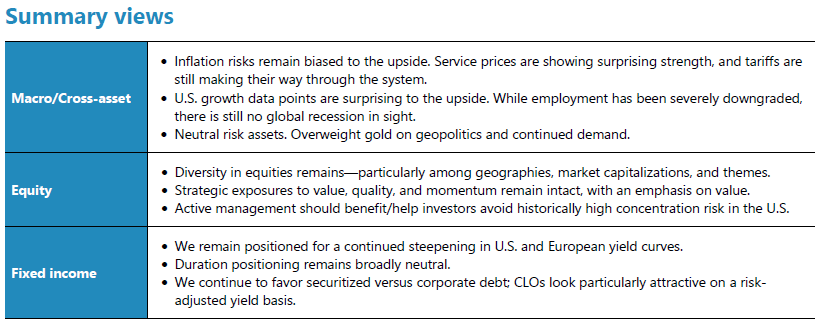

Not surprisingly, diversification within equity markets remains our key call for the remainder of 2025. Diversification by geography, by our preferred factors, by sector, by single names, and by theme will help investors reduce their exposure to what we see as heightened market fragility. Active management also appears attractive here, particularly in U.S. large caps given the acute market concentration.

Credit has reflected the elevated valuations in equity markets, as evidenced by low spread level. We remain interested in attractive risk-adjusted yields which can be found in securitized sectors, particularly collateralized loan obligations (CLOs).

Our preference for yield curve steepeners in the U.S. and Europe has played out nicely given easy monetary policy’s influence on the short end and debt concerns boosting the long end. While yield curves have moved dramatically, we believe conditions remain in place for a further widening between short- and long-term yields. Overall interest-rate sensitivity is broadly neutral and focused on the belly (intermediate section) of the curve.

Finally, in terms of positioning, we remain long inflation via breakeven yields on strength in services and expectations for more significant tariff flow through into prices and future inflation expectations. Gold continues to look attractive despite recent highs due to continued geopolitical concerns and our view that both investors and central banks will continue to be solid sources of demand.

Regarding the U.S. government shutdown to start the fourth quarter, the market impact will clearly be dependent on the length of this latest budget fight while the more immediate effects will include the suspension of government statistics releases, including the monthly employment report. The lack of data combined with the potential for a large number of furloughed federal workers could solidify two more rate cuts in 2025. While predicting politics is at times harder than predicting the market, our expectations are that this will be resolved in a reasonable amount of time with a relatively modest market and economic impact.

As always, we would like to thank our readers for their continued support.

Indexes

*Tales of the tape: U.S. equity: S&P 500 Index; Global ex-U.S. equity: MSCI ACWI ex-U.S. Index; Global Treasurys: Bloomberg Global Treasury Index; Commodities: Bloomberg Commodity Index.

Indexes definitions

The Bloomberg Commodity Index comprises futures contracts and tracks the performance of a fully collateralized investment in the index. This combines the returns of the index with the returns on cash collateral invested in 13-week (three-month) U.S. Treasury bills.

The Bloomberg Global Treasury Index tracks fixed-rate, local currency government debt of investment grade countries, including both developed and emerging markets.

The Cboe Volatility Index (VIX) measures the constant 30-day volatility of the U.S. stock market using real-time, mid-quote prices of S&P 500 Index call and put options. A call option gives the holder the right to buy a stock at a specified price; a put option gives the holder the right to sell a stock at a specified price.

The FTSE China Technology Index tracks the performance of large and mid-cap technology companies in China's equity market.

The MSCI ACWI ex USA Index tracks the performance of both developed-market and emerging market countries, excluding the United States.

The Russell 2000 Index tracks the performance of the small-cap segment of the U S. equity market. The index is a subset of the Russell 3000 Index, which comprises the 3,000 largest U.S. companies, and includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership.

The S&P 500 Index is a market-weighted index that tracks the performance of the 500 largest publicly traded U.S. companies and is considered representative of the broad U.S. stock market.

Glossary

A basis point equals .01%.

Collateralized loan obligations (CLOs) are securities that have been created by pooling together smaller high-yielding fixed income assets such as bank loans. These pools are then packaged into various tranches (a slice or portion of a structured security) according to credit quality, maturity etc.

Corporate debt is debt that is issues by corporations.

Magnificent 7 refers to the mega cap technology and technology-related U.S. stocks of Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia, and Tesla.

Momentum is a trend-following investment strategy that is based on acquiring assets with recent improvement in their price, earnings, or other relevant fundamentals.

Quality comprises a long-term buy-and-hold strategy that is based on acquiring shares of companies with strong and stable profitability with high barriers of entry (factors that can prevent or impede newcomers into a market or industry sector, thereby limiting competition).

Risk assets, such as equities, commodities, high-yield bonds, real estate, and currencies, carry a degree of risk and generally are subject to significant price volatility.

Risk-adjusted yield refers to the concept of adjusting the yield of a security higher or lower based on the level of risk associated with that security.

Securitized debt refers to bonds that provide interest and principal payments that are backed by the cash flows from another pool of assets.

Value is an investment strategy that is based on acquiring assets at a discount to their fair valuations. Mean reversion is a theory that prices and returns eventually move back towards their historical average.

Important information

Index returns are for illustrative purposes only and do not represent actual investment performance. Index performance returns do not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index. Past performance does not guarantee future results. Diversification may not protect against market risk.

This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events or a guarantee of future results. All information as of the date indicated. There are risks involved with investing, including possible loss of principal. This information should not be relied upon by the reader as research or investment advice, (unless you have otherwise separately entered into a written agreement with SEI for the provision of investment advice) nor should it be construed as a recommendation to purchase or sell a security. The reader should consult with their financial professional for more information.

Statements that are not factual in nature, including opinions, projections and estimates, assume certain economic conditions and industry developments and constitute only current opinions that are subject to change without notice. Nothing herein is intended to be a forecast of future events, or a guarantee of future results.

Certain economic and market information contained herein has been obtained from published sources prepared by other parties, which in certain cases have not been updated through the date hereof. While such sources are believed to be reliable, neither SEI nor its affiliates assumes any responsibility for the accuracy or completeness of such information and such information has not been independently verified by SEI.

The information contained herein is for general and educational information purposes only and is not intended to constitute legal, tax, accounting, securities, research or investment advice regarding the strategies or any security in particular, nor an opinion regarding the appropriateness of any investment. You should not act or rely on the information contained herein without obtaining specific legal, tax, accounting and investment advice from an investment professional.

The views contained herein are not to be taken as advice or a recommendation to buy or sell any investment in any jurisdiction. Our outlook contains forward-looking statements that are judgments based upon our current assumptions, beliefs, and expectations. If any of the factors underlying our current assumptions, beliefs or expectations change, our statements as to potential future events or outcomes may be incorrect. We undertake no obligation to update our forward-looking statements.

Information in the U.S. is provided by SEI Investments Management Corporation (SIMC), a wholly owned subsidiary of SEI Investments Company (SEI).

Information in Canada is provided by SEI Investments Canada Company, a wholly owned subsidiary of SEI Investments Company (SEI), and the Manager of the SEI Funds in Canada.